Have States gained from the 16th FC?

The story so far:The 16th Finance Commission under the chairmanship of Dr. Arvind Panagariya has submitted its report for the period of 2026-31. The Central government has accepted its recommendations with respect to devolution of funds from Centre to States.

What were past recommendations?

The Constitution in Article 270 provides for the scheme of distribution of net tax proceeds collected by the Central government between the Centre and the States. The taxes that are shared between the Centre and the States include corporation tax, personal income tax, Central Goods and Services Tax (GST), Centre’s share of the Integrated Goods and Services Tax (IGST) etc. This division is based on the recommendation of the Finance Commission that is constituted every five years as per the terms of Article 280. This divisible pool, however, does not include cess and surcharge that are levied by the Centre. For the year, 2025-26, it is estimated that the divisible pool constitutes only around 81% of the gross tax revenue of the Centre after excluding cess and surcharge.

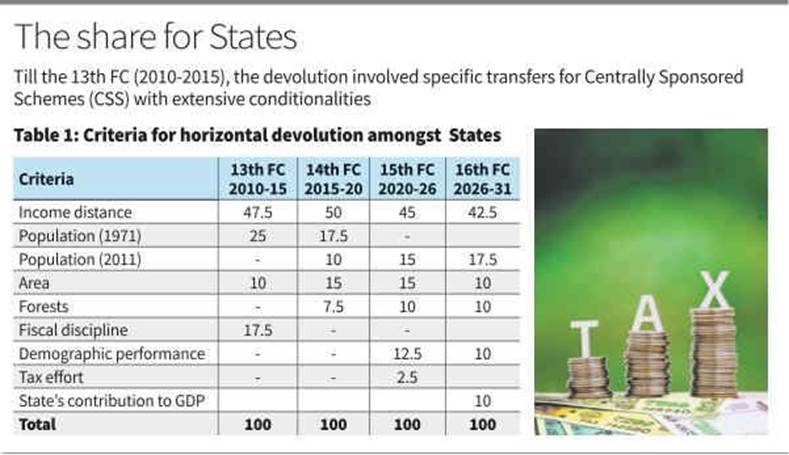

Till the 13th FC (2010-2015), the devolution involved specific transfers for Centrally Sponsored Schemes (CSS) with extensive conditionalities. The share of States in Central taxes (vertical devolution) was fixed at 32%. However, since the 14th FC (2015-2020), the specific transfers for CSS were discontinued and the vertical devolution was increased to 42%. It was revised down to 41% in the 15th FC (2020-2026) due to the reorganisation of Jammu and Kashmir into two Union Territories.

The criteria for distribution amongst the States (horizontal devolution) since the 13th FC is provided in Table 1. As can be observed, higher weightage has been given for equity (income gap) and needs (population and area) when compared to efficiency (forests, demographic performance and tax effort).

What were States’ demands?

Firstly, as regards vertical devolution, 18 States had demanded that the States’ share be increased from the current 41% to 50%. Few other States had demanded an increase of 45% to 48%. Many States had demanded the inclusion of cess and surcharge in the divisible pool as well as fixing a cap on cess and surcharge that could be levied by the Centre.

Secondly, as regards horizontal devolution, many States had pitched for the continued dominance of equity parameters in the criteria. Equally, many States had recommended reducing the weight assigned to ‘income distance’ as a criterion. Industrialised States such as Maharashtra, Gujarat, Tamil Nadu, Karnataka and Telangana had recommended the inclusion of States’ contribution to GDP among the horizontal devolution criteria.

What did the 16th FC recommend?

With respect to the demands regarding vertical devolution, the FC opined that under the present constitutional scheme, it is neither permissible nor desirable to fix a cap on cess and surcharge or for their inclusion in the divisible pool. These instruments may also be needed to raise resources for the Union to meet any exigencies. Similarly, the FC recommended retaining the States’ share in vertical devolution at its current level of 41% considering three main reasons — the States’ share in total tax revenues of the country; that much of the spending of the Union in CSS is anyway ultimately routed to the States; and that the Union government needs increased funds for defence and infrastructure.

In its approach for horizontal devolution, the FC was guided by two principles. First, changes to each State’s share in the portion of divisible pool should be gradual. Second, due recognition should be given to efficiency and especially the States’ contributions to growth. Accordingly, a new criterion of State’s contribution to GDP has been added. The weightage to this new criterion as well as other criteria has been assigned in such a way that it spells a directional change without causing a drastic shift in States’ shares.

Considering all the above factors, the share of southern and western States has marginally increased while the share of big north and central States has marginally decreased. Hence, one may conclude that it is status quo as far as vertical and horizontal devolution is concerned with a directional change towards providing due recognition for efficiency. Additionally, the following observations of the FC should be borne in mind. The Centre should progressively reduce raising revenues through cess and surcharge. The States should make their subsidies efficient and targeted, actively pursue reforms in the power sector, and rein in the levels of their fiscal deficit and debt. The Centre and States should undertake various public sector enterprise reforms.

During the WAVES Summit in Mumbai, Prime Minister Narendra Modi underlined India's developing position in the global creative economic sector. During his opening address, India earned the description of an "orange economy" because cultural and creative sectors drive both financial growth and job creation. Rajnikanth and Mukesh Ambani joined

The Mahahtra government achieved a historical milestone by returning to India the historic sword of Raghuji Bhosale I during a Sotheby’s auction in London, which belonged to a notable 18th-century Maratha ruler. The state of Mahahtra achieves its first success in acquiring historical artifacts from international auctions. The bidding

Stay updated with The Hindu Editorial Vocab24 app, your definitive source for breaking news and comprehensive coverage from India and around the globe. Whether it's political developments, business updates, sports highlights, the latest technology trends, or current events, The Hindu brings live, accurate, and reliable news directly to your device.

Don’t fall for sensationalized or fake news shared online. Read and share accurate updates with friends and family through The Hindu Editorial Vocab24 app. Download it today!

News Coverage in The Hindu Editorial Vocab24 App

Breaking News: Receive instant notifications on breaking news stories as they unfold. Stay informed about major events and developments in India and around the world with live blogs, news in shorts videos, and concise articles.

Politics: Get the latest updates on Indian politics, including elections, policy changes, government decisions, and political events that shape the nation.

Business and Economy: Stay ahead in the economic landscape with detailed business news and market analysis. Learn about stock market trends, financial reports, corporate news, and economic developments to make informed investment decisions.

Current Events: Follow stories on social issues, policy changes, global events, and daily current affairs, tailored for UPSC and other competitive exam preparations.

Technology: Keep up with the latest gadgets, innovations, and tech trends. Read expert reviews and analyses in short, concise updates on cutting-edge technology from India and beyond.

Sports: Never miss a moment of your favorite sports. Get live scores, match reports, and expert analysis on cricket, football, tennis, and more.

International News: Stay informed about global events and geopolitical developments, including the Russia-Ukraine war, Israel-Palestine conflict, and other key international stories.

Local News: Stay connected to your community with the latest updates on city events, issues, and local news. Coverage includes hyperlocal updates from cities like Bangalore, Chennai, Delhi, Hyderabad, Mumbai, Kolkata, and more.

Trending Topics: Discover what's trending today with the most talked-about stories and hot topics across India and the world.

Experience journalism that values integrity, accuracy, and reliability. Download The Hindu Editorial Vocab24 app today and stay connected with the world.

Subscribe to our newsletter!